In May 2023, EU Commission President Ursula von der Leyen delivered a powerful message to the European parliament, declaring that a growth model centered on fossil fuels is outdated. Her address emphasized that embracing a green transformation is crucial, signaling that the regulatory power chambers are aligning with strong climate ambitions. As the fossil fuel industry faces mounting pressure, the World Benchmarking Alliance (WBA) has been monitoring the efforts of major oil and gas (O&G) producers in decarbonisation and just transition performance. The results paint a down-beat picture with significant room for improvement but also important examples of leading practices.

Risking the goals of the Paris Agreement: fossil fuel companies falling short

The second iteration of WBA’s Oil and Gas Benchmark, published in June 2023, assessed 100 key companies responsible for approximately 80% of global oil and gas production. None of the benchmarked companies have committed to halting expansion or ceasing exploration for new reserves before 2030, and only a handful acknowledge the necessity of reducing production in the long run. Moreover, most companies focus solely on setting Net-Zero targets for their operational emissions (scope 1 & 2), overlooking their substantial responsibility for scope 3 emissions, which often account for over 80% of their total emissions.

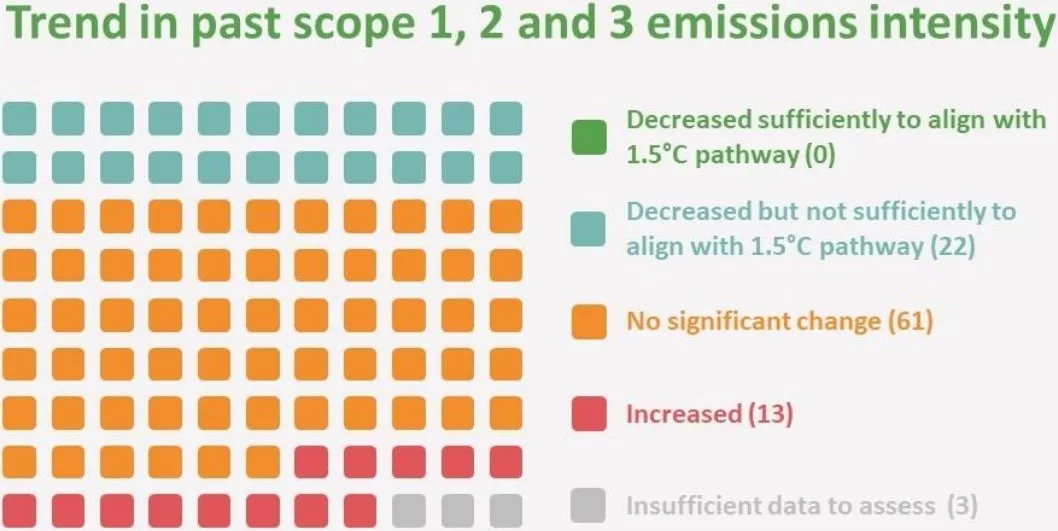

Distribution of companies’ trends in past scope 1, 2 and 3 emissions intensity

At their current pace, emissions of the benchmarked companies will exceed their collective 2022-2050 carbon budget by 2036, with projected locked-in scope 3 combustion emissions totaling a staggering 301 Gt CO2. Considering that the available budget to limit global warming to 1.5°C is only 250 Gt CO2, the current trajectories and plans of these companies put the goals of the Paris Agreement at great risk.

Falling short on low-carbon investments

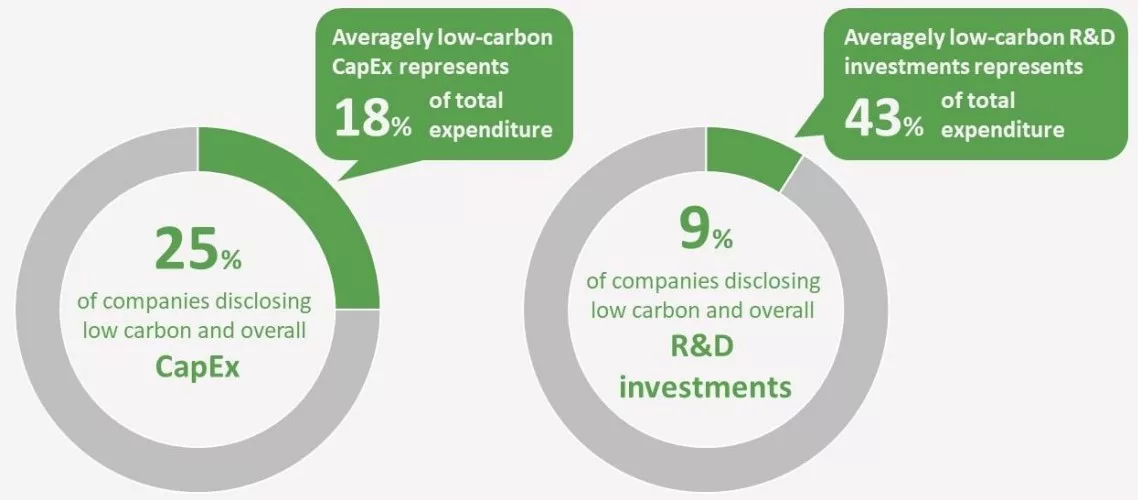

One of the most concerning aspects of the O&G sector’s performance is its failure to meet sectoral-level expectations regarding low-carbon investments. On average, companies’ low-carbon capital expenditure (CapEx) represents a mere 18% of their overall expenditure, while low-carbon research and development (R&D) accounts for an average of 43% of total R&D spending. Although these figures show a slight improvement from the 2021 benchmark, only 25% of the assessed companies report their low-carbon capital expenditure shares, severely undermining the transparency and credibility of their transition planning. Considering the sector earned a whopping USD 4 trillion in 2022, it becomes imperative in subsequent benchmarking exercises to evaluate whether profits are redirected towards ramping up low-carbon CapEx and R&D.

Shares of companies disclosing low-carbon CapEx and R&D investments data and related performance

Empowering workers in just transition planning and ensuring human rights

WBA’s benchmarking approach goes beyond emissions and stranded assets to evaluate companies’ overall transition efforts, including their engagement with workers on just transition and respect for human rights. While an increasing number of companies are now engaging with stakeholders to understand diverse perspectives of a just transition (15% in 2023 compared to 8% in 2021) only 5 companies go one step forward in showing how they have engaged in social dialogue and had meaningful engagement with stakeholders.

In the 2023 O&G benchmark, 56% of companies were committed to respecting human rights, but deficiencies were noted in translating these commitments into real actions to manage human rights risks. Companies must prioritize identifying human rights risks in their own operations and throughout the supply chain, followed by robust due diligence procedures to address these issues effectively.

Learning from leading practices in the sector

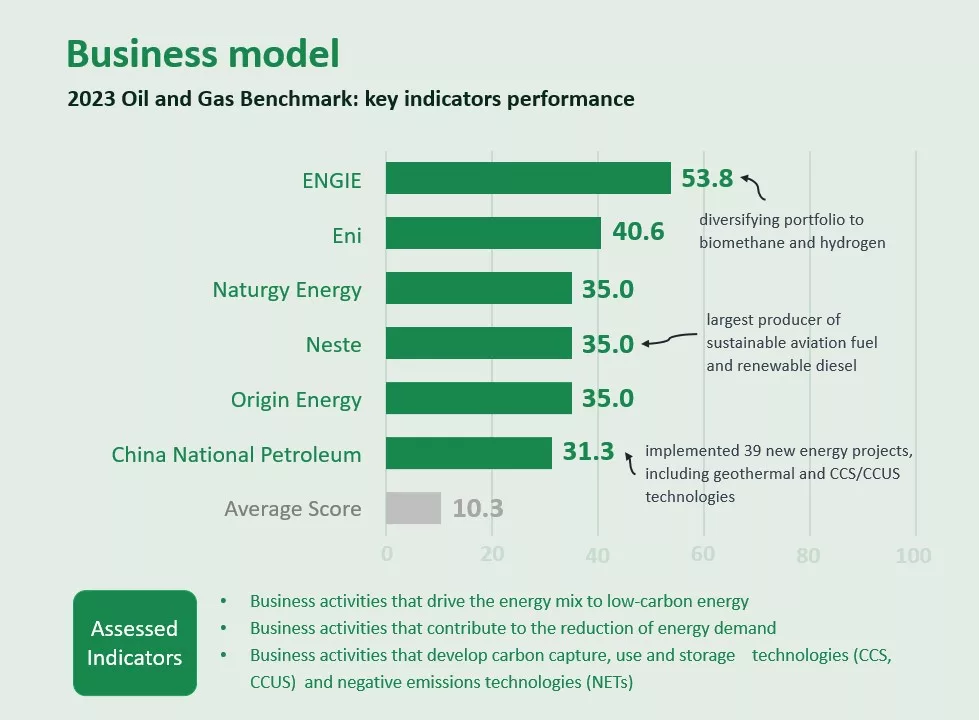

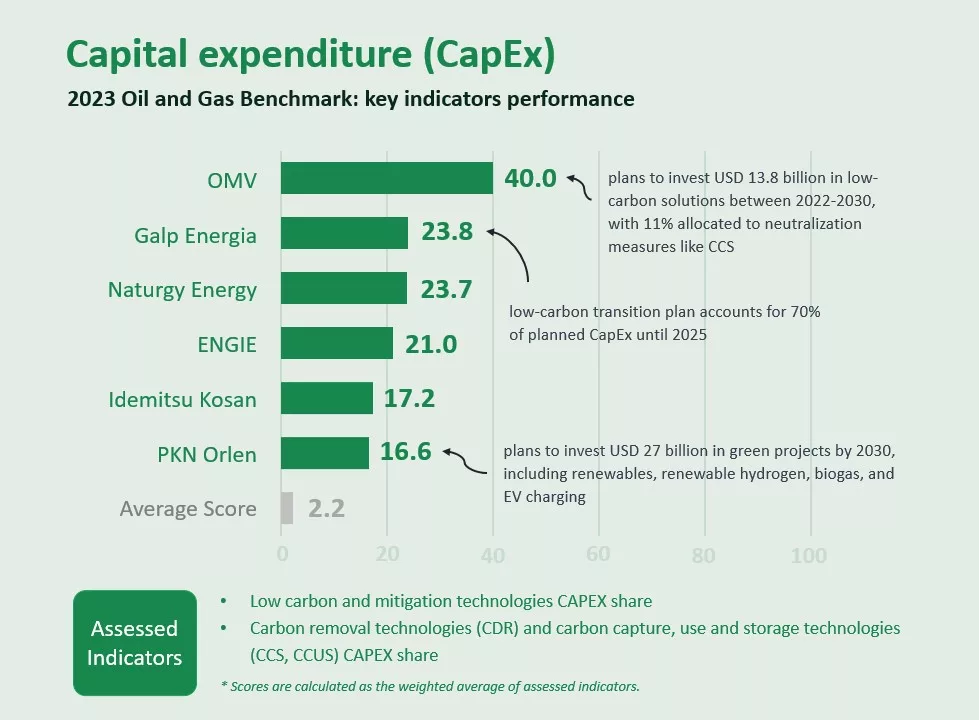

Although the overall progress of the O&G sector has been disappointing between 2021 and 2023, there are examples of leading practices to be found. Best-performing companies in WBA’s Oil and Gas Benchmark have set ambitious net-zero targets for scope 1, 2, and 3 emissions, complemented by intermediate targets for reducing upstream emissions. This is the case of Eni that has set the interim reduction targets of 35%, 55% and 80% of its total emissions by 2030, 2035 and 2040 respectively. Leading companies are now taking important steps in setting sound financial commitments to low-carbon technologies and greening business models by diversifying energy portfolios and product offerings. Engie is a case in point with its renewables segment a profitable and significant part of the company’s business, generating 18% of the company’s earnings. Engie is also planning a rapid expansion of this segment targeting 80 GW by 2030 and a significant expansion of its renewable hydrogen and biomethane businesses between now and 2030. Finally, while CapEx shares in low carbon technologies is overall low in the sector, some lead companies are starting to align closely with the investment levels required for the transition. OMV is investing 40% of total CapEx in low carbon technologies, including commercial unproven ones such as CCS. Between 2023 and 2025, Galp Energia plans to allocate USD 750 million annually to the implementation of its low-carbon transition plan, which represents 70% of the company’s planned CapEx for the period. These values are close to the 39% and 60% benchmark trajectory of annual low-carbon energy investments in 2020 and 2030 that are conducive with a 1.5 degree scenario.

Leading practices found in WBA’s 2023 Oil and Gas Benchmark: indicators referring to business models and capital expenditure

Closing the accountability gap and paving the way for sustainability

The gap between leading practices and the overall sector underscores the urgency of change. The successes of some companies should serve as a blueprint for the entire O&G sector to adopt sustainable practices as the first step towards a greener and equitable future across the value chain. In doing so, companies would substantially start narrowing their corporate accountability gap on sustainability. While it is widely acknowledged that transitioning to a low-carbon future presents challenges for industries, there are multiple cases where the execution is simply falling too short. As legislative pressure mounts, companies will eventually need to step-up their implementation game but will only find that they failed to do their share in delivering the Paris Agreement. Alternatively, companies should strive to be “first movers or innovators” on climate action today and deliver their fair share of action to their best abilities. Failing to do so would put the world at risk and be a step backward for corporate accountability. It is time for the O&G industry to rise to the challenge and become a driving force in the global effort to combat climate change.